by Patrick Mayr

The synthesis of NFTs and DeFi promises to unlock utility for all types of NFTs by enabling their use in a host of financial services. A segment within this space that we’re excited about is NFT-backed lending.

Most loans in DeFi today are either overcollateralized with fungible tokens or un(der)collateralized. NFT-backed lending, as the name implies, is a lending structure that collateralizes loans with NFTs.

Liquid collateral such as fungible tokens are typically preferred to less liquid assets like NFTs, because they can be priced more accurately and easily liquidated, making them lower risk. To compensate lenders for the additional risk they assume, interest rates across NFT-backed lending markets are higher. Additionally, NFTs accepted as collateral need to go through specific whitelisting processes. Most of the whitelisted collateral across the lending NFT protocols today are blue chip NFT collections such as Punks, Bored Apes or Autoglyphs, which maintain the most liquid markets.

NFT Lending Models

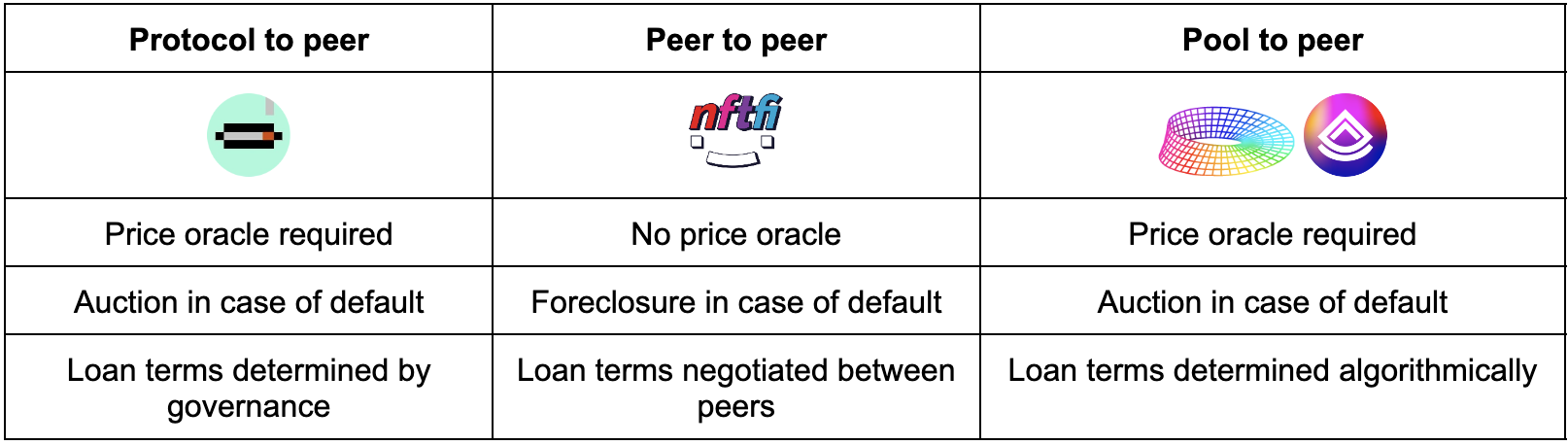

As with fungible token-backed lending, we’ve seen 3 main NFT-backed lending models emerge.

Protocol to Peer

In protocol to peer (protocol2peer) lending markets, borrowers interact directly with the protocol as their counterparty. Maker pioneered this lending model for fungible token-backed lending and is also working on gradually expanding into NFTs. JPEG’d is, however, the protocol to take an NFT-first approach.

Borrowing

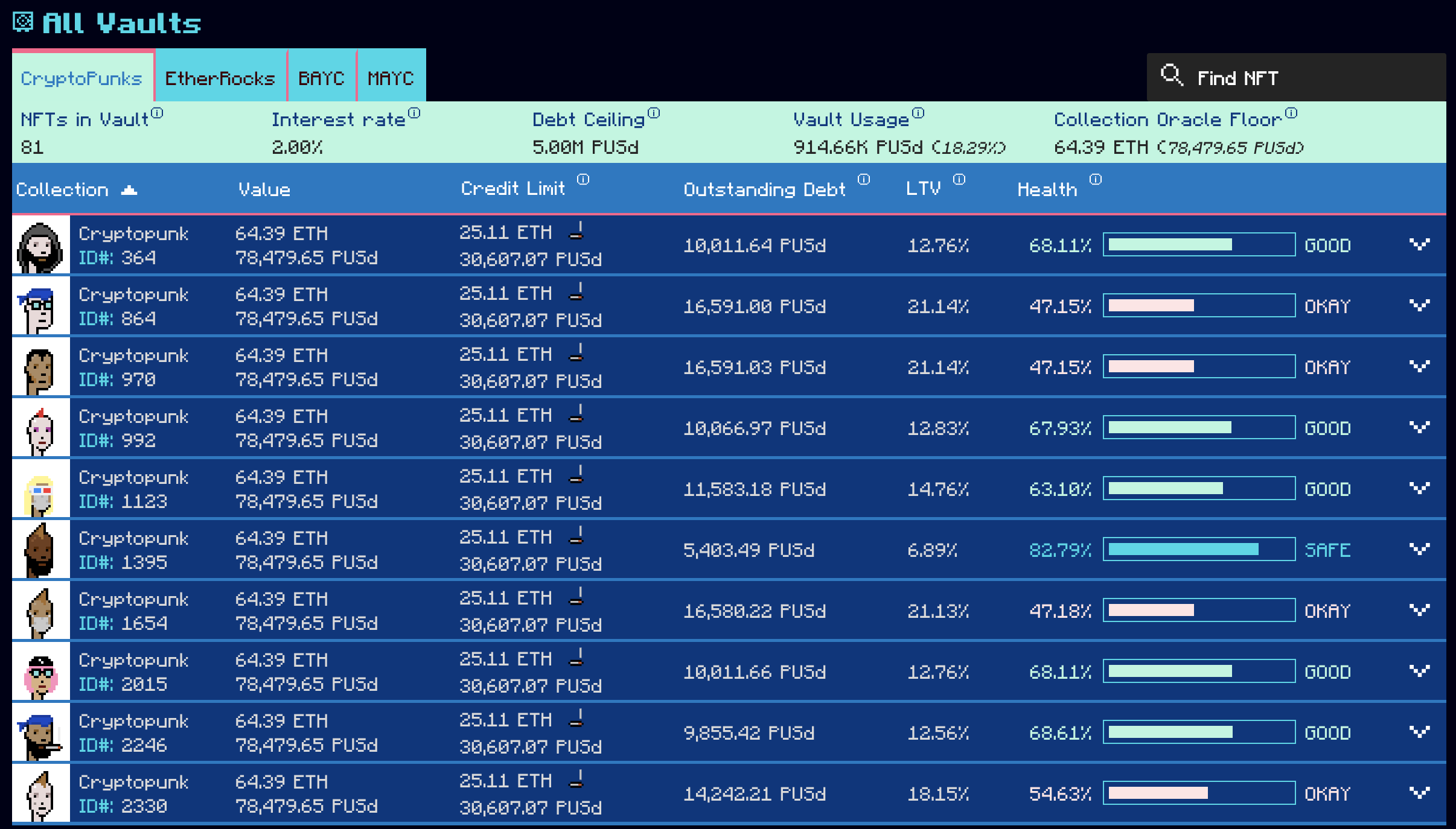

In order to take out a loan on JPEG’d, borrowers lock their NFTs as collateral in a CDP (collateralized debt position) and in return receive the protocol’s native synthetic stablecoin, pUSD. pUSD is to JPEG’d what DAI is to Maker. In order to retrieve their NFT, borrowers need to repay the loan’s principal and interest.

Liquidations

The liquidation ratio is the point at which LTV surpasses a certain threshold and triggers the liquidation of the NFT collateral. Liquidation ratios are risk parameters put in place to ensure the solvency of lending protocols by preventing the value of a loan from exceeding the value of the underlying collateral. Protocols usually set a liquidation ratio at an LTV far lower than 1 to further reduce risk of any particular loan falling underwater. To process a liquidation, the protocol auctions the underlying NFT collateral to the general market.

Specifically working through an example makes this clearer. Assuming an LTV of 32% and liquidation ratio of 33% (current parameters on JPEG’d), depositing an NFT valued at 100 USD as collateral allows me to take out 32 USD worth of debt in pUSD. Now if my NFT drops in price from 100 USD to 90 USD, LTV becomes 35.5% (32 USD / 90 USD) and is above the liquidation ratio. At this point my position is marked for liquidation and my NFT auctioned off to the highest bidder by the protocol. The proceeds generated by the sale are retained by the protocol and an equal amount in pUSD retained by protocol treasury is burned to close my entire position .

Pros

- Instant liquidity if NFT collateral is whitelisted

- Loans issued at zero marginal cost

Cons

- Only native stablecoin can be borrowed

- Stablecoin needs to gain adoption/acceptance outside of protocol’s internal ecosystem to be useful for borrowers

- Protocol takes bundled risk against all NFT collateral supported; harder to scale across NFT classes/categories

- Exogenous oracle required

Peer to Peer

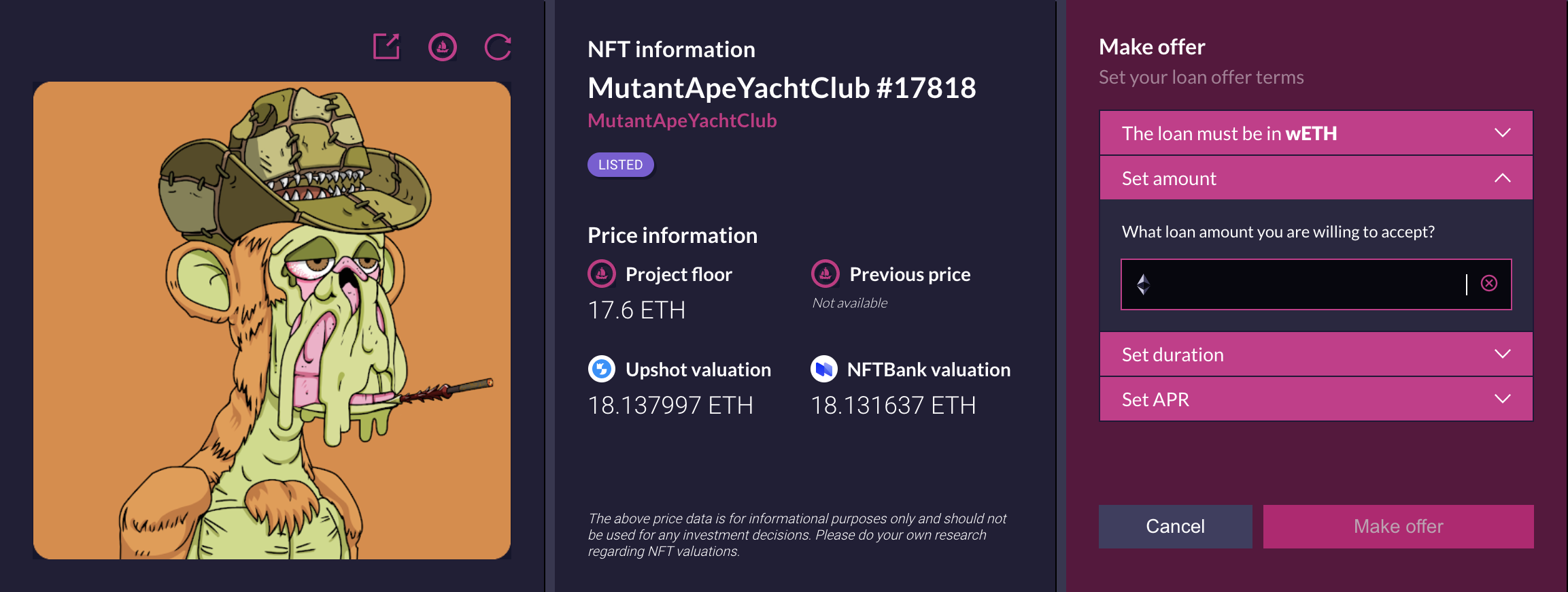

Peer to peer (p2p) lending markets offer the most flexible structure as they can facilitate any loan that two parties mutually agree to. While the type of trades that can be negotiated are limited by the rules of the protocol, there are few theoretical limits. NFTs still need to go through a whitelisting process, but the p2p structure allows for the widest range of accepted collateral. NFTfi is the leading protocol that has adopted this model.

Borrowing

In order to take out a loan on NFTfi, borrowers submit a loan request that defines desired terms and the NFT provided as collateral. Lenders can then extend offers on the requests that are collateralized with a particular NFT they like.

After a deal is struck the NFT is moved into the protocol’s smart contracts and held in escrow until the expiry of the loan. Interest and loan duration are defined up front and fixed for the entirety of the loan. A fixed loan duration negates the need for a liquidation ratio that manages loan risk in real time, as borrowers either repay the loan on time or default. That and because loans are priced directly by peers means that an exogenous pricing oracle is not required.

Liquidations

When a borrower defaults on a loan the lender can either take the NFT collateral into his/her possession or negotiate a different repayment schedule with the borrower. A key distinction of the p2p model from others is that the marginal buyer of the NFT collateral (the lender) is already established in advance, confining the risk of any transaction to a particular lender and absolving the protocol from having to trigger an auction in the event of a default.

Pros

- No oracle required

- Loans issued in widely accepted tokens (ETH and DAI)

- Marginal buyer for the NFT already established upfront with protocol taking no risk

- Easy to scale across NFT classes/categories

Cons

- Less immediate liquidity

- Tough to scale liquidity without professional lenders (market makers)

- More complex user experience

Pool to Peer

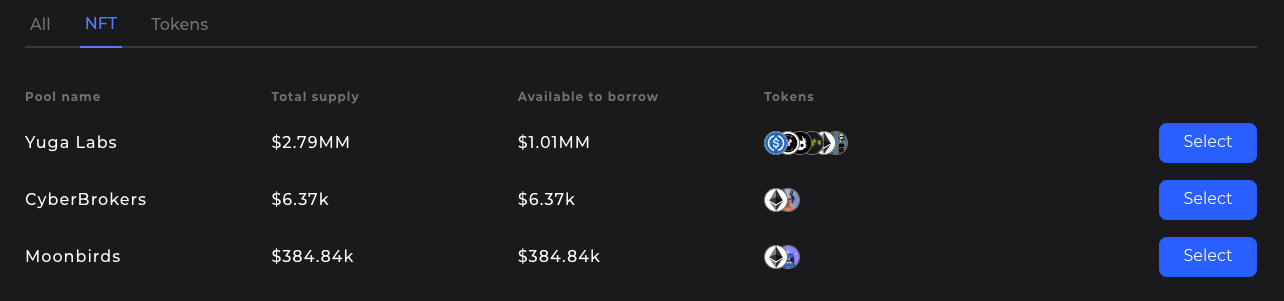

In pool to peer (pool2p) lending markets, users don’t need to find a specific peer but instead trade with a pool of assets sourced from a distributed and often permissionless set of lenders.

Compound and Aave are notable examples of lending markets for fungible tokens built on the pool2p model. In NFT lending, BendDAO and Drops are the main projects of note.

Borrowing

To take out a loan, borrowers deposit their NFT collateral into a smart contract and in exchange draw a loan at a variable interest rate that is calculated algorithmically depending on the pool’s utilisation over time. The loan duration is variable, with LTV and liquidation ratio configured by governance. Similar to protocol2p markets, Chainlink oracles are required to calculate the real-time valuations of deposited NFTs. While there are slight differences in calculation methodologies used by the different protocols, they are more or less all similar at the moment.

Pools are categorised by the type of NFT collateral that underpins the loans. For example, on Drops there are Yuga Labs, CyberBrokers and Moonbirds pools. This allows lenders to select which NFTs they want lending exposure to and the protocol to isolate and contain idiosyncratic risk of any particular collection. For example, if Moonbirds experienced a rapid drop in prices that results in a lot of liquidations, and possibly bad debt, those effects are confined to the Moonbirds pool and don’t affect the Yuga or CyberBrokers pools.

Liquidations

Similar to the protocol2p model, when the LTV of a loan in a pool2p market reaches the liquidation ratio, its collateral can be liquidated via an open market auction with the proceeds distributed back to the affected lending pool.

Pros

- Strong liquidity if NFT collateral is whitelisted

- Ability to scale through pooled liquidity

- Loans issued in widely circulated tokens (ETH and DAI)

- Ability to easily isolate risks from distinct NFT classes/categories; easy to scale across

Cons

- Less capital efficient than p2p models due to borrower/lender mismatch

- Exogenous oracle required

Pricing oracles are a bottleneck

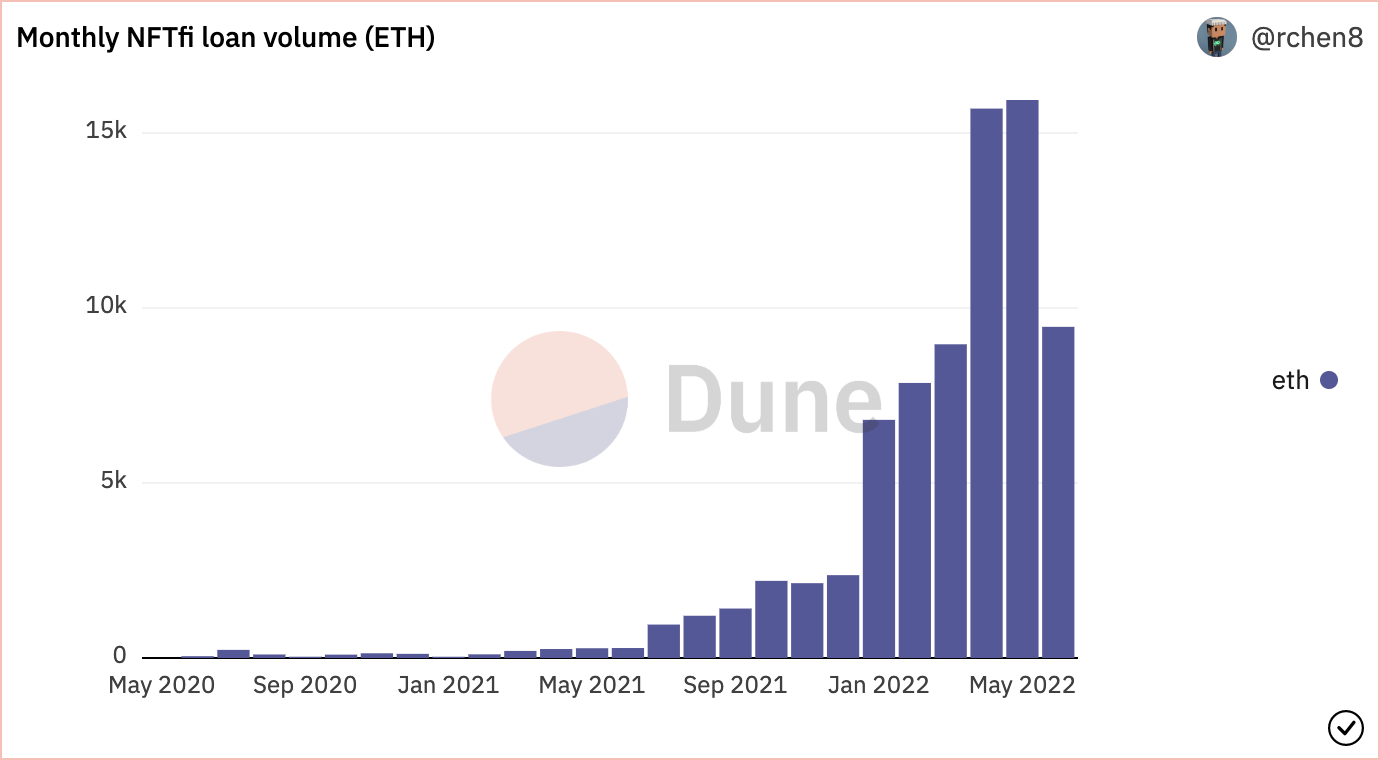

NFTfi, a p2p lending protocol, is currently the market leader in terms of cumulative loan volume with around $211m. BendDao, the largest pool2p protocol, sits at around $52m in loan volume (at ETH price of $1.2k) while JPEG’d has issued around $13m in loans.

What’s interesting is that the opposite is true for fungible token-backed lending. The leading protocols—Compound, Aave, and Maker—are not p2p.

P2p lending is more difficult to scale and requires more active liquidity to work, which begs the question why it is the initial leading model for NFTs. The simple answer is that it doesn’t require pricing oracles: unlike in fungible markets, one of the most difficult things to establish for NFTs are their real time valuations. Floor prices are often used but 1. are not actually the floor because they only indicate the lowest price at which someone is willing to sell, not buy, and 2. not accurate because NFTs are by definition non-fungible and have a variety of different characteristics that are all priced differently. While new and improved pricing oracles are currently in development, models not requiring them have remained easier to construct and trust.

Metastreet: pool delegate mechanism for NFT lending

One interesting model in NFT lending to emerge that strikes a compromise by leveraging both the benefits of p2p marketplaces and pool2p marketplaces, no oracle requirement and pool capital respectively, is the pool delegate model pioneered by Metastreet.

In contrast to the other discussed protocols, Metastreet does not facilitate primary but only secondary market transactions. When lenders enter into a loan agreement with borrowers on p2p marketplaces such as NFTfi, they are issued a promissory note that reflects the terms of the loans and puts into code an obligation to fulfil those terms. Once lenders have entered into loan agreements their only option is to wait for the duration of the loan to elapse to receive their principal and interest.

Metastreet, through its secondary marketplace, allows lenders to sell their loans (promissory notes) to willing buyers at any point in time. The protocol operates pools that are open for anyone to deposit capital into and are managed by vault governors who decide on loans to buy. While Metastreet is currently the exclusive vault governor, there are plans to allow third parties to manage pools in the future.

The vault governor prices the loan, which negates the need for an oracle, and capital from multiple lenders is aggregated in pools, which allows for scale. While Metastreet is focused on the secondary market the same model could be applied to the primary market.

Maple has been using this model to great effect on the credit side. The large majority of loans on Maple are uncollateralized on-chain but secured through legal agreements that give lenders off-chain guarantees. Pricing these loans, similar to NFT-backed loans, is more difficult than loans collateralized by fully on-chain liquid collateral and requires expertise. Maple operates a pool delegate system, which allows financial institutions such as Orthogonal and Maven11 to manage open pools of capital that they direct towards financing loans. Capital can be supplied by any type of lender, but loan underwriting is exclusively done by the institutions.

Why does this matter?

While the thought of having a loan backed by a “monkey JPEG” can seem gimmicky, the implications are profound.

First off, the experience of taking out an NFT-backed loan is far superior to the cumbersome process of taking out loans backed by a physical asset. Visits to a bank branch, lengthy paperwork, and the logistics of dealing with physical assets are replaced with a few clicks at the computer. As we spend more of our time and money online, new rails need to be established that unlock utility for all digital assets that represent an ever-increasing share of our wealth.

Secondly, NFT backed lending won’t be confined to just a subgroup of PFP collections. We’re already seeing RWA (real world assets) such as invoices or mortgages turned into NFTs that can then be used as collateral for loans. Ultimately anything can in theory be represented as an NFT–digital assets like punks or apes, physical assets like property, and intangible assets like credit scores or any other form of reputation.

There are still a myriad of things that need to be built to work towards that vision. On-chain identity remains an important piece that can be a massive unlock. One can imagine collateralizing a loan with an NFT that represents a credit score instead of a priced asset. The bridging of physical assets on-chain both from a technical and legal point of view remains a challenge but is being worked on. For example, Courtyard bridges physical assets on-chain, starting with trading cards. Assets that are minted as NFTs on Courtyard are kept in secured vaults and can be redeemed at any point in time by the holder of the NFT. Building foundational tooling for the DeSci space, Molecule has developed a legal wrapper that ties a real-world legal claim on IP to NFTs.

We’ve so far proven that NFTs can be created in abundance. The next step is to unlock their full financial utility.

Special thanks to Brett Sun and Luca Prosperi for their thoughts and comments on this post.