We recently shared this market update as part of our 4Q2022 update to our own investors. We’d like to share this context more broadly as it may be helpful to founders, LPs, VCs, and others elsewhere.

Q4 brought us the final pieces to a tumultuous year in crypto, with the insolvency of FTX capping off a series of blowups and insolvencies across the industry. 2022 was hard on the global economy and tech more broadly speaking, but especially so on crypto. Rising interest rates, loose risk management practices and a succession of fraudulent actors are unsurprisingly not a healthy blend for a young and emerging technology.

This was a year of tough lessons for the crypto industry. In the immediate term, the consequences of these lessons will bring about their fair share of pain and cast a curtain of doubt on the industry. Yet in the long term, with the industry purged of get-rich-quick personas and fraudulent empires, we believe the stage is set for a new era of innovation and long-term oriented adoption.

While our outlook for 2023 is more positive than 2022, this coming year will ultimately be about survival. Capital for follow-on financing rounds is aplenty but will not flow into every opportunity like it has in the past. Only the best founders and companies will continue to attract financing, as it always should’ve been.

In spite of all the hardship crypto has had to endure this past year, we have never been more convinced of the opportunity ahead of us. Just like in 2001, it is not the headline-grabbing blow ups that one should watch to understand how the future may unfold but the slow, unrelenting pace of progress in the underlying technology and roll out of infrastructure.

The collapse of FTX

The collapse of FTX in November marked one of the most difficult moments in crypto’s history, comparable with the collapse of crypto exchange Mt. Gox in 2014. Given its recency and immense scale, it is still difficult to fully comprehend the full picture at play although more and more clarity is coming to light through the ongoing bankruptcy and federal prosecution proceedings.

On the surface, FTX’s insolvency was kicked off by an online joust between FTX’s founder, Sam Bankman Fried (SBF), and the founder of its largest rival Binance, Changpeng Zhao (CZ). Binance had been among the earliest investors in FTX but was forced to exit its position in 2021 by other FTX investors once it became clear that FTX and Binance were directly competitive. In return for the sale of its FTX shares, Binance received $2.1b, split between USD stablecoins and FTT, FTX’s native token.

At the beginning of November, CoinDesk published an article insinuating Alameda, FTX’s largest market maker and sister venture founded by SBF, was both holding the majority of its balance sheet in FTT and borrowing significantly against that collateral. Shortly after, CZ publicly announced on Twitter that, due to “recent revelations,” he had lost confidence in FTX and would start selling Binance’s FTT holdings.

CZ’s tweet sparked a loss of confidence in the exchange that began with FTX customers rushing to withdraw their deposits and ended with FTX halting withdrawals shortly thereafter. As we already saw with Celsius, Voyager and BlockFi, when a lender or exchange pauses withdrawals, it’s almost certainly because they are insolvent. Once again, that turned out to be the case.

FTX’s immediate response was to look for a buyer, and for a short period it looked as if Binance, of all parties, would acquire FTX. However, that deal quickly fell through after Binance was confronted with the sober reality of FTX’s true financial position: a balance sheet with a multi-billion dollar hole.

Once the drama of the initial sequence of events settled, it became clear that FTX’s problems ran much deeper than its public spat with Binance. It was revealed that SBF had illegally lent out customer deposits to Alameda. While SBF had run Alameda for a long time as its CEO, he publicly relinquished his CEO position in fall 2021 to assuage fears of a conflict of interest that running both FTX and Alameda presented. In practice, however, SBF remained heavily involved in Alameda and tried to help Alameda claw its way out of steep losses by misappropriating customer funds from FTX as trading capital. At the moment it is also suspected that SBF may have used customer funds for personal expenses.

SBF has since been arrested and charged with 8 counts of fraud and conspiracy by the Department of Justice (DOJ) and is facing civil suits from Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). If found guilty, SBF will go down as one of the biggest fraudsters in US history and will likely spend the majority of his life behind bars.

The primary effects of the FTX fallout are twofold. The first are simply the large financial losses incurred by FTX customers. FTX has over 1 million creditors that are owed approximately $8B. The second is the reputational damage. SBF was purported to be “one of the good guys.” He was a frequent presence on Capitol Hill, heavily involved in crafting crypto regulation, and was one of the largest political donors in the most recent US midterm elections. It turns out the regulation he was pushing for would have been favourable to FTX at the expense of its competitors and it’s possible the political donations were done so with FTX customer deposits.

It’s clear that more regulation will be introduced as a response. More regulatory clarity would be welcomed and is something the industry has been crying out for, for a while. However, it’s important that any new regulation be rooted in facts, not dogma. Regulators and politicians with an anti-crypto agenda will use FTX as a pretext to regulate crypto out of existence. The irony is not lost on those regulators that wanted to regulate everyone but FTX. In fact if FTX were built on crypto infrastructure, which it wasn’t as a centralised exchange, these series of events would have been impossible. Some politicians already understand that. It’s critical that more do too.

FTX contagion

The impact of FTX’s bankruptcy will undoubtedly ripple across the industry for some time. However, a first wave of contagion was triggered immediately following the events due to the exchange’s large presence as a borrower, trading venue, and pillar of support in the Solana ecosystem.

DCG, and its prime-broker subsidiary Genesis, have come under immense pressure following both the insolvency of 3AC in June and now FTX. As the pioneering prime-broker in crypto, Genesis acted as the largest venue of borrowing and lending liquidity across the market with up to $3b in active loans at the time of the FTX collapse. A week later, Genesis itself suspended withdrawals to institutional clients who held deposits.

As of this writing, it appears DCG has struggled to attract additional capital to continue normal operations. It has begun to scale down or completely shutter a number of subsidiaries, including Genesis and Grayscale, which operates the largest and best known “Bitcoin pseudo-ETF” GBTC.

Moving past DCG, we arrive at a second class of industry players caught in the contagion: liquid funds and market makers. These participants were attracted to FTX by its deep liquidity but have suffered greatly from both the seizure of their assets and the loss of an important trading venue for generating revenue. Market makers have been largely attributed with outflows of assets from exchanges, with Binance processing a net outflow of $3.6b, or 5% of total assets, from its exchange over a single week in December.

Finally, after DCG and market makers, there’s SBF and FTX’s heavy involvement in the Solana ecosystem. To many, SBF was a significant champion of the ecosystem with FTX and Alameda playing a comparable role to the one that Consensys did in the early days of Ethereum. However, it’s important to note that Solana and FTX’s relationship was much more structurally intertwined and their loss is proving to be the toughest test yet for the young ecosystem.

Alameda in particular was often counted amongst the ecosystem’s best users, providing both liquidity in total value locked (TVL) and trading volume. As for FTX, unfortunately many projects held portions of their treasuries there and now have to contend with a shortened runway. But perhaps most structurally damaged was Solana’s DeFi infrastructure. Shortly after the collapse, it became widely known that FTX was both the sole holder of the upgrade key to a critical module, known as Serum, that implemented trading functionality as well as the issuer of a widespread set of synthetic assets meant to represent assets from other crypto networks. These revelations sent the developer community scrambling to relaunch the Serum module and attempt to unwind out of the now un-backed synthetic tokens.

Solana’s ongoing situation serves as yet another reminder that good things, in this case a strong and robust network devoid from any central actor that is “too big to fail,” often require time and a strong cultural commitment from leaders and participants alike.

Ethereum’s continued technological march

We continue to point to Ethereum as the go-to example of an ecosystem that has, since inception, embodied a strong commitment towards an uncompromised development roadmap. While much criticised between 2018 and 2019 for “not going fast enough,” it is due to that formative period that the ecosystem stands on its strong foundations today.

Embodying this, Vitalik in November released an updated roadmap for Ethereum’s foreseeable future to address criticisms around the susceptibility of the newly transitioned PoS network to state-level censorship. These threats, although technical, can be summed up by two vectors: validator node hosting and block production. Both relate to potential governmental or single-actor jurisdictional powers: Ethereum validators today are predominantly hosted in the US and Germany within AWS data centres, and for block production, the PoS upgrade’s redesigned incentives has resulted in as many as 70% of all new blocks being actively censored in order to comply with OFAC sanctions (e.g. preventing interactions with Tornado Cash). While still innocuous today, both are a far cry from the censorship-resistant ethos that Ethereum was built on.

Ethereum’s updated roadmap includes attempts at tackling both parts. Although focused work will have to wait until after the upcoming Shanghai upgrade scheduled for this March—when withdrawals will finally be enabled for staked ETH—community sentiment has rallied around immediately prioritising development around these censorship concerns in parallel with scaling-oriented features.

In particular, we look forward to the Ethereum community tackling research into Secret Leader Election (SLE), a novel consensus engine upgrade on top of PoS that will hide the proposer of any given block, and Proposer-Builder-Separation (PBS), a field of research that seeks to fundamentally re-design the block construction process, as upgrades that will improve the network’s overall censorship-resistance. In the near term, we are also excited by the forthcoming EIP-4844 scalability upgrade that will come after ETH redemptions are enabled. This single upgrade will dramatically reduce the cost of transactions on Ethereum-based Rollups, with Arbitrum and Optimism projected to reach sub-cent individual transactions and similarly large reductions for upcoming Zero-knowledge Rollups from Polygon, Starkware, and Matter Labs.

Although there are no exact timelines yet, we look forward to the Ethereum community tackling these significant upgrades over the next 6-12 months:

Ethereum’s strong relative strength

2022 has seen a consolidation of activity and total value locked (TVL) towards Ethereum and its related “Layer 2” (L2) scaling solutions, Arbitrum and Optimism. Base layer Ethereum (“Layer 1” or L1) has continued to exhibit robust demand, attracting a consistent market share of TVL (60% of global) and continuing to process transactions at its max theoretical output. In the downturn, Ethereum and its closely related Layer 2s have shown strong signs of a loyal, sticky user base rather than one largely driven by retail speculation in the broader hype cycle.

Newer competitors, including Avalanche and Solana, have struggled to continue growing usage after peaking towards the end of 2021. This is in spite of their ability to process higher levels of transaction throughput—they simply were not able to attract the demand. Most notably, the TVL figures for these competitors have sharply and consistently fallen over the course of the year. Avalanche and Solana now hold only 8% ($800m from $10b) and 4% ($200m from $5b) of their respective TVL figures when compared against the beginning of the year.

Indeed, 2022 has seen these newer non-Ethereum networks forced to shift their competitive stance from Ethereum itself to Ethereum’s L2 networks. In a clear trend of adoption, both Arbitrum and Optimism have matured from their initial beta launches in the fall of 2021 to become dominant networks in their own right. Having started the year with only a few thousand daily users, they have both grown rapidly to average 50k daily active addresses throughout December. Combined, the two now process the same number of transactions as Ethereum L1’s max theoretical output (15-20 transactions/second) with still a lot of room to grow as demand is onboarded. Furthermore, both networks surpassed Avalanche and Solana in TVL with Arbitrum holding $1b and Optimism $500m at the end of the year.

The quarter in 3 charts

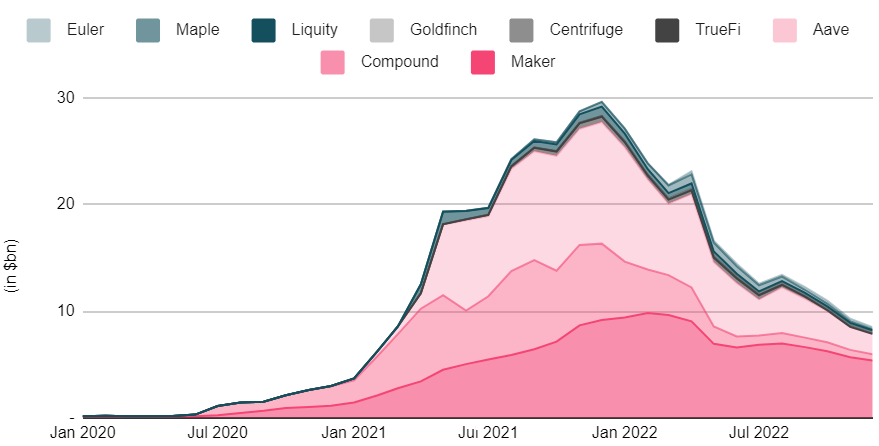

Outstanding loan volume

DeFi lending protocols experienced a sustained downward trend in outstanding loan volume this quarter, as rising interest rates in traditional financial markets and a reduction in risk-taking appetite rendered opportunities in DeFi as less attractive.

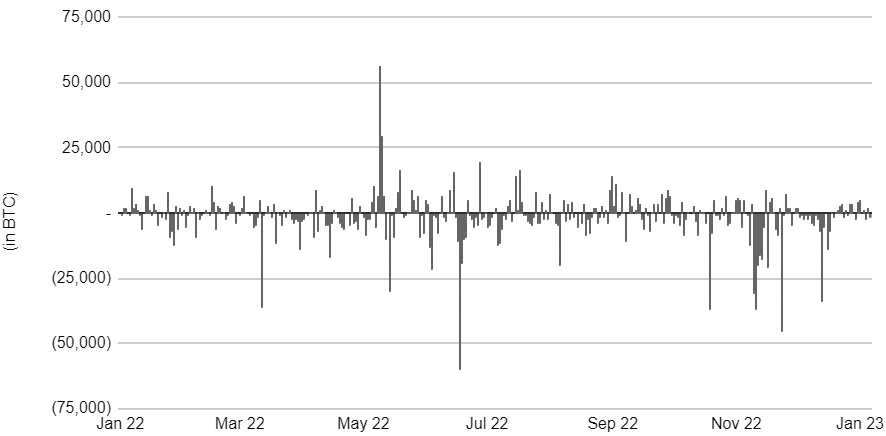

BTC netflow volume from/to exchanges

Following the insolvency of FTX we witnessed strong net outflows of BTC from exchanges to self-custody. FTX was another sharp reminder of the perils of keeping assets on centralised exchanges. It will be interesting to track the adoption of self-custody solutions over the coming months.

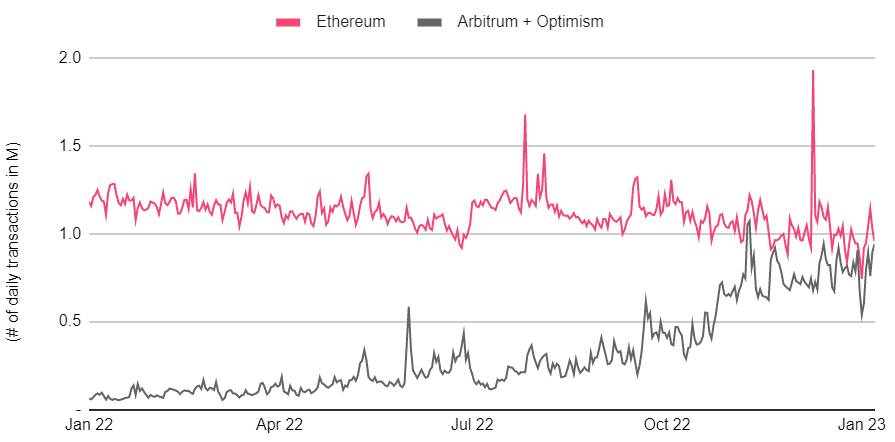

Daily transactions on optimistic roll-ups

The number of daily transactions on Arbitrum and Optimism have seen a strong uptick in recent months and together now process a similar number of transactions as Ethereum L1.

The number of daily transactions on Arbitrum and Optimism have seen a strong uptick in recent months and together now process a similar number of transactions as Ethereum L1.