We recently shared this market update as part of our 3Q2024 update to our own investors. We’d like to share this context more broadly as it may be helpful to founders, LPs, VCs, and others elsewhere.

This quarter felt much like the previous one, with public markets remaining flat and parts of the industry eagerly searching for new narratives. However, rather than any fresh, exciting trends emerging, the focus has been on executing and delivering on existing ones. There was no larger tide lifting all boats; instead, success was more localised with individual companies performing well and continuing to secure funding.

Network states

The second edition of the annual Network State Conference took place in Singapore in September. The idea of a network state was introduced and popularised by Balaji Srinivasan, an entrepreneur and former CTO of Coinbase. Unlike traditional nation-states, which are defined by physical borders, network states are built around shared values and interests, primarily formed through digital constructs but oftentimes establishing physical presences as well. The network state movement is inspired by places like Dubai and Singapore, which have rapidly evolved from relative obscurity into major global business hubs within just a few decades.

Much like cryptocurrency, network states aim to provide an alternative to the status quo. Rather than attempting to reform existing states, they propose a parallel system. In the same way that DeFi creates a parallel financial system and DeSci seeks a new approach to scientific research, network states offer an alternative to traditional nation-states. The hope is that, in the future, these parallel systems will gain momentum and increasingly intersect with existing ones, leading to meaningful competition and change.

The Network State movement, though still in its infancy, has already inspired numerous founders to start companies. One of the most active categories thus far has been popup cities with notable examples being Zuzalu, Edge City, and the Network School led by Balaji Srinivasan. As their names suggest, popup cities temporarily establish communities in specific physical locations, where residents co-live together for a defined period. These initiatives aim to demonstrate they can bring together like-minded individuals, often strangers, to form cohesive living communities. Over a dozen such popup cities have been organised over the past year with Zuzalu, Edge City, and the Network School all hosting concurrent cities this fall in Asia.

Another category of startups is focused on creating more permanent establishments. Prospera, for example, is developing a special economic zone on the Honduran island of Roatan. Inspired by the models of Hong Kong and Dubai, Prospera has laid out its own legal and regulatory framework designed to encourage economic activity. One community within Prospera, called Vitalia, leverages these regulations to accelerate drug development and has already attracted a number of biotech entrepreneurs to establish their businesses there.

The Network State movement has encountered its share of challenges, including legal disputes with some of the jurisdictions where physical establishments are hosted and negative coverage from mainstream media which often dismisses the movement as a utopia for “crypto bros.” Like any emerging tech movement, it has both positive and less favourable aspects. However, the ambition of creating new cities and communities from the ground up in a 21st century and digitally native format is a bold vision that deserves recognition and support.

Realising the DeFi mullet: intersecting crypto and fintech

DeFi is about creating new infrastructure for financial services and is as a result a back-end revolution. Fintech has largely been a front-end revolution. Companies like Revolut, N26, Monzo, and Nubank have succeeded by creating more user-friendly interfaces for banking services. However, the infrastructure and financial rails that these neobanks rely on are the same systems used by traditional players like Chase, Deutsche Bank, and Bank of America.

The “DeFi mullet” thesis suggests that the optimal intersection between fintech and crypto lies in each focusing on their strengths: fintech excels at customer acquisition, while crypto provides superior, more efficient infrastructure. This means fintechs can move away from relying on outdated systems and start building on crypto-based rails instead. From both ends, we’re beginning to see this “DeFi mullet” thesis materialise. Most notably, fintech giants Revolut and Robinhood both expressed interest in launching their own stablecoins last month. Over the summer Paypal pushed for growth in its stablecoin, PYUSD, with over $1bn circulating on-chain at its peak in August. PYUSD has been fully integrated in Venmo since last year allowing users to send, receive, and hold PYUSD within the app.

From within crypto, we see two trends emerging. One, exemplified by companies like Morpho, is leading the charge for fintechs to integrate crypto-based lending functionalities. Swissborg, a mobile app, now leverages Morpho’s decentralised infrastructure to provide its users a savings yield product. The other we see is a new set of fintechs built from day one on crypto rails while also offering seamless banking or traditional payments functionalities such as card payments. These new apps, such as Gnosis Pay and Yellow Card, aim to provide consumers the same proposition as traditional fintechs by abstracting the crypto complexities but are able to more efficiently build towards a compelling feature set utilising crypto infrastructure.

As we noted last time, DeFi has continued to mature in the background. There now exists many more mature protocols and tools for operators to manage risk. We believe what we’ve seen over the last months are the first steps towards a new wave of adoption driven by the intersection of fintech leveraging crypto’s more efficient infrastructure.

zkTLS: cryptographic guarantees for the rest of the internet

Amongst the numerous advancements we’ve witnessed over the past year in applied zero-knowledge cryptography, zkTLS stands out as one of the most important. At a high level, zkTLS (or “Web Proofs”) allows a user on the web to prove that they received a specific piece of information from the internet without revealing the entirety of the data. This information could be a simple text message, a bank account statement, or ownership of a ticket issued by Ticketmaster.

While we are still in the early stages of experimenting with this technology and continue to rapidly improve its underlying infrastructure, a few products have already been built that showcase features otherwise not possible without zkTLS. ZKP2P stands out as the most prominent, having first built a peer-to-peer on/off-ramping product that protects users anonymity and guarantees payments through verification of payment confirmation emails issued by Venmo and Revolut. This initial product has processed over $150k in volume since it was launched last November. The team have since incorporated the technology into secondary marketplaces for web domains and event ticketing where users benefit from guaranteed ownership (ie. no fraudulent listings), lower fees, and near instant delivery.

The quarter in 3 charts

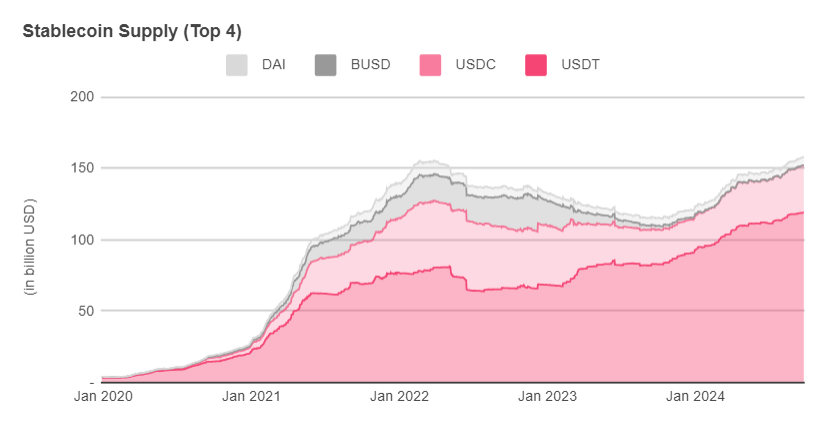

Stablecoin supply hitting new all-time high

The supply of stablecoins reached an all-time high of over $150bn in Q3, reflecting their growing mainstream adoption. Stablecoins have emerged as the preferred unit of account in crypto, particularly within DeFi, and are steadily capturing market share from the traditional remittance and cross-border transaction flows.

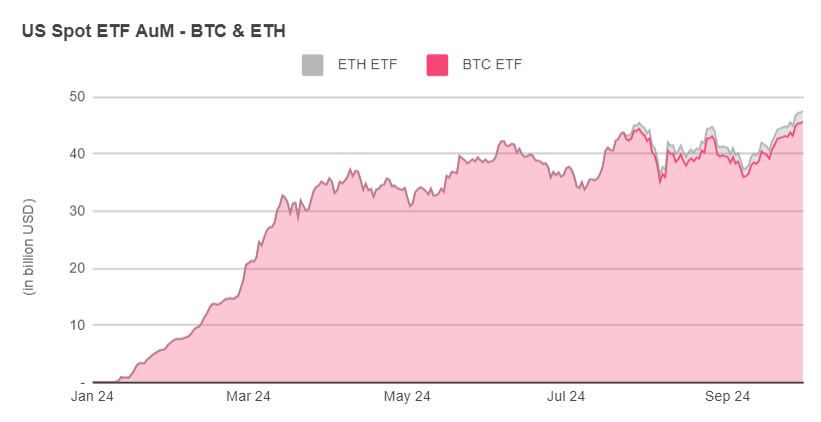

Institutional interest driving ETFs to new AuM highs

Since its launch in January 2024, the Bitcoin ETF has experienced a steady inflow of capital and recently reached a new high of $45bn in AuM (excluding Grayscale). In July, the highly anticipated launch of the Ethereum ETF followed, quickly attracting significant investor interest and accumulating $2bn in AuM (excluding Grayscale).

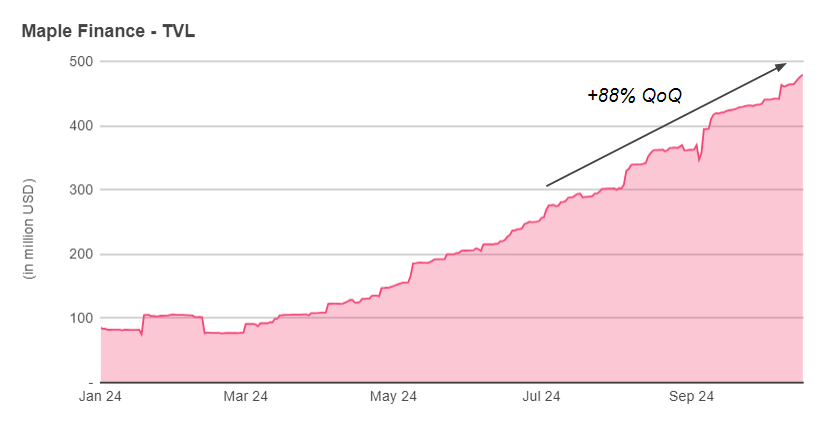

Maple experiencing TVL surge as institutional lending market recovers

Maple has established itself as the leading institutional lending market, now benefiting from a resurgence in institutional lending activity. As trust returns to the market, lenders and borrowers are engaging more actively, driving growth in both lending capital and demand for loans. By the end of Q3, Maple’s TVL reached $470m, marking an 88% increase from the previous quarter.