by Patrick Mayr

A theme within web3 that we are particularly excited about is the bridging of the traditional financial system and DeFi.

We have a strong belief that over time more and more financial functions will be ported onto DeFi rails. While for some functions that can take more time, lending is ready today.

The structural advantages of DeFi lenders over traditional lenders are their native transparency and unbiased enforceability. As seen over Q2 2022, when the poor risk management practices (low quality loan book, too much leverage, loan duration mismatches) of centralised lenders - Celsius, BlockFi, Voyager - became apparent, consumer trust eroded and triggered bank runs that these lenders couldn’t withstand. In the case of traditional lenders, trust comes from a customer’s belief in a company.

In DeFi, by contrast, trust comes from open source software and smart contracts. As we wrote in our Q2 market commentary:

“DeFi lenders are completely transparent: loan books, addresses of borrowers / lenders, collateralization type, and leverage ratios are all open for anyone to see. Transactions are executed by software and not subject to human subjectivity. Risk management requirements are baked into the code. There are no arbitrary bailouts or backroom dealings.”

Maple

Maple is a DeFi protocol for institutional lending. As opposed to more retail focused DeFi protocols such as Aave, Compound and Maker that require users to overcollateralise their loans, Maple enables institutions to take out loans with very little to no on-chain collateral. Instead, loans are secured with an off-chain legal agreement that gives lenders the ability to pursue recourse in the event of a default. Loans are issued entirely on-chain with crypto assets such as USDC or ETH.

Maple is not a lender itself but functions as a marketplace. The supply side of the marketplace are lenders that want to earn interest on their crypto assets and the demand side institutions that want to borrow those assets at a certain cost of capital.

The coordination mechanism between supply and demand is centred around Maple’s system of Pool Delegates. Pool Delegates are permissioned institutional investors that create and manage pools of capital used to finance loans on Maple. They run due diligence on prospective borrowers, decide which to issue loans to, and service the loans. The pools are open for anyone with a crypto wallet to deposit tokens into. Pool Delegates also have to deposit their own capital to align interests with all other lenders. Current Pool Delegates on Maple include Credora, Genesis, Orthogonal, and Maven11 amongst others.

Maple is currently operating on the Ethereum and Solana blockchains.

Blending DeFi and TradFi

Overcollateralised lending protocols can exist entirely on-chain because each loan is backed by collateral that can be permissionlessly custodied and liquidated in the event of a default. While overcollateralised lending addresses certain users, it excludes others, notably institutions that either do not have enough on-chain collateral, or are accustomed to access loans in traditional finance backed by their business metrics rather than collateral. In order to service those users, Maple has created a product that is a blend between DeFi (on-chain) and traditional finance (off-chain).

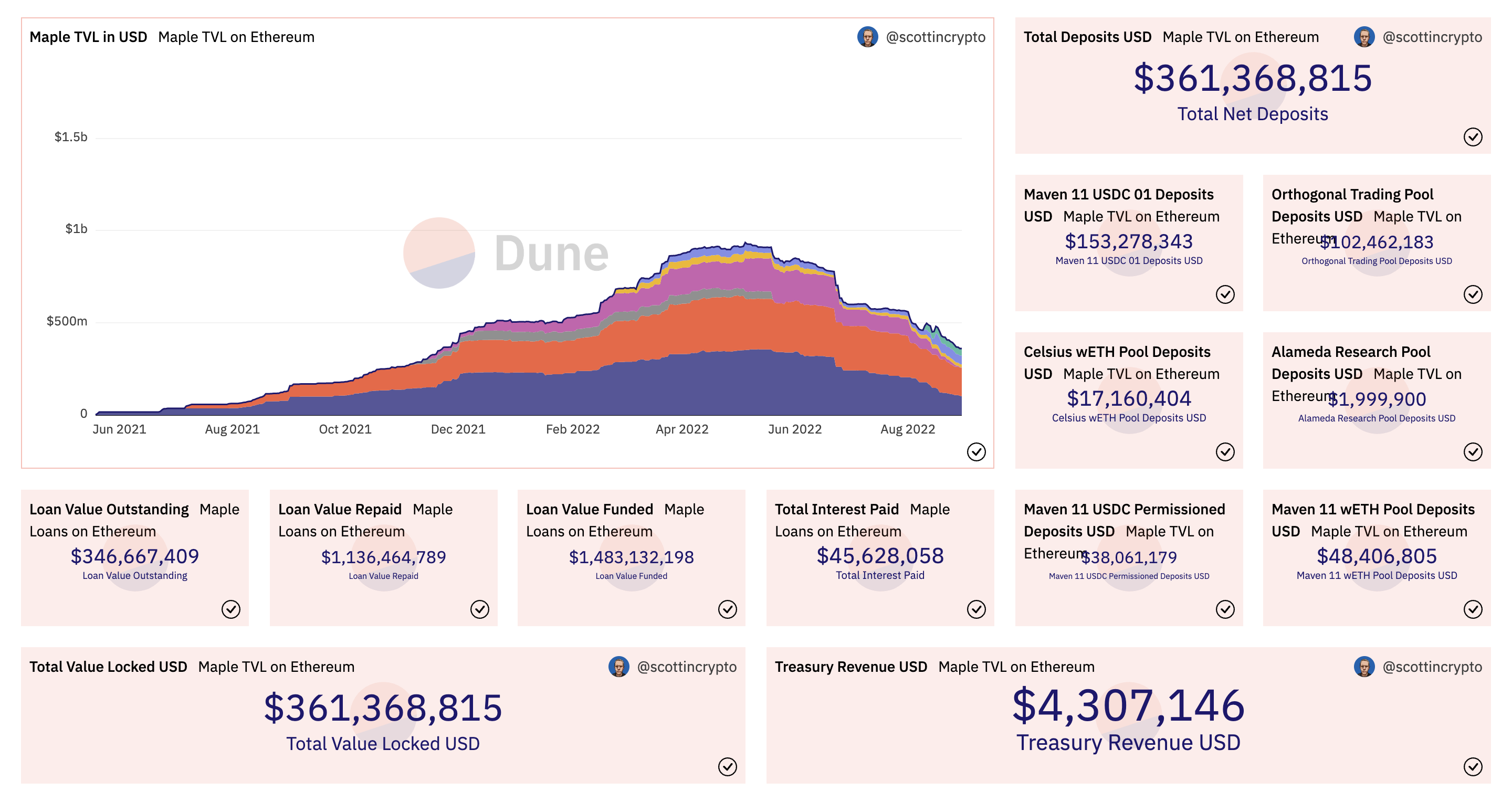

The flow of assets happens entirely on-chain. All loans are issued on-chain, giving anybody the ability to access loan data and get a complete overview of the loan book. Below is a Dune Analytics dashboard created by somebody outside the Maple team that gives an in-depth insight into Maple activity. Any other investor could do the same. Lenders can verify performance of the loan book independently.

The rules that govern all cash flows in the lending pools are executed by smart contracts. For example, there are clear rules on how lenders can withdraw their assets. Over the past couple of weeks lenders in crypto experienced net asset outflows due to uncertainty in the market. Whereas centralised lenders arbitrarily paused withdrawals in an attempt to cap the outflow of capital, the Maple smart contracts functioned as designed: if lenders followed the withdrawal procedures and there were assets in the pools available, those assets could be withdrawn. Pool delegates could not change the rules by themselves.

While the flow of funds is on-chain, the diligence of lenders and the legal agreement to protect lenders in case of default are off-chain components of the Maple protocol. By blending on-chain and off-chain components, Maple has created a protocol that wouldn’t be possible if it were purely on-chain, and is superior to products that are purely off-chain.

Going forward

Maple is the market leading institutional credit protocol in DeFi. It has more than tripled its cumulative loan volume of $542m at the beginning of the year to approximately $1.667B today.

We have recently built up an MPL position on the open markets. Launching a token is in our view a product release that occurs early in the lifecycle of a decentralised network. As such we believe that public markets investing in liquid tokens is an important part of early stage investing in web3. We look forward to supporting the Maple team in their effort to build the best in class protocol for institutional lending.